palm beach county business tax receipt phone number

Business Tax Application Exemptions. City of Key Colony Beach 305 289-1212.

Palm Beach County Tax Collector PO.

. Looking for FREE property records deeds tax assessments in Palm Beach County FL. The information needed include. These records can include Palm Beach County property tax assessments and assessment challenges appraisals and income taxes.

When paying by credit debit card keep in mind that a 24 convenience fee applies min. Worth Pensacola FL 32504. Box 3353 West Palm Beach FL 33402-3353.

Click on the order now tab. Forman et al Case Number. The cost of a Business Tax Receipts varies according to the type of business and must be renewed annually.

You are required to complete the correct application see Forms pay fees and in most cases have inspections in order to comply and be issued a local business tax receipt formerly known as occupational license. View information about the City of Boca Raton business tax receipts. Layton City Hall 305 664-4667 City of Marathon 305 743-0033.

Customer Service Review. The NOC must be recorded at Palm Beach County Recording Department located at 205 North Dixie Highway 4 th Floor. Palm Beach County receives in excess of 5 million court documents each year totaling more than 15 million pages.

The first small jet-powered civil aircraft was the Morane-Saulnier MS760 Paris developed privately in the early 1950s from the MS755 Fleuret two-seat jet trainerFirst flown in 1954 the MS760 Paris differs from subsequent business jets in having only four seats arranged in two rows without a center aisle similar to a light aircraft under a large. Before an Okaloosa County Business Tax Receipt can be obtained a business must meet all conditions required by the city county state or federal agency regulations which apply to that business or occupation. Royal Palm Beach Commons Brochure A three 3 story 17000 sf.

3864972456 Fort White. Furnished lobby area restrooms office storage canoekayak shop kitchen and dining area along with 1900 sf. And on weekends from 10 am.

Sporting Center consisting of 8000 sf. City of Delray Beach Tax Records https. You will be directed to another page.

Per County Ordinance 2015-A21 effective July 1 2016 a taxicab business must provide proof of automobile insurance with the minimum limits of 300000 combined single limit CSL when applying for or renewing a Business Tax Receipt. Welcome to the City of Palm Beach Gardens application process. The Okaloosa County Tax Collectors Office offers several methods to make paying drivers license transactions easier and more convenient.

Including business names locations phone. The City of Palm Beach Gardens is a unique place to live learn work and play. To donate via check or money order mail to The Salvation Army of Palm Beach County 2100 Palm Beach Lakes Blvd West Palm Beach FL 33409.

General Maintenance Handyman. Pay your ticket online by mail by phone or in person at one of our courthouse locations. To donate via text.

Attend driver school in lieu of receiving points on your license. If you relocate your business you are required to apply for a new local business tax receipt. Quickly search property records from 28 official databases.

Convenience fees are collected by the credit debit card vendor and are not retained by our office. A 6 percent service charge will apply. If you cant pay your ticket in full we can help you establish a monthly payment plan.

City of Boca Raton Business Licenses. Danny Crank Butler County Recorder. 714 834-3411 Customer Service Representatives M-F 9am-5pm Automated Information 24 hours 7 days a week Fax Number.

Why do I need a local business tax receipt for Palm Beach County. County of Orange Attn. Business tax is regulated by Florida Statute Chapter 205 as well as City.

Make sure you notify our office to avoid penalties. Business tax is a tax you pay to the City for the privilege of doing business in the City. A bank card fee is applicable for debitcredit card payments per FL Statute 215322.

Customers can pay in person using a debitcredit card issued by Visa MasterCard Discover or American Express. Information pertaining to Business Tax Receipts Brevard County Tax Collectors Office 321-264-6969 or 321-633-2199. Professional or personal email address professional or personal telephone phone number and account preferences.

Your business tax receipt from the city or county your business is domiciled in. The Village of Wellingtons Local Business Tax Receipt is valid from October 1 st through September 30 th. Before a Monroe County Local Business Tax can be issued a business must meet all county state or federal agency regulations which apply to that business or occupation.

Phone number for fort white office. Panama City Beach District. Palm Beach County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Palm Beach County Florida.

Call the Business Tax Department at 561-791-4000 for license types fees and other pertinent information. A 6 percent service charge will apply. Filling the forms involves giving instructions to your assignment.

Create your account perform and manage our relationship with you and our Customers. Box 1438 Santa Ana CA 92702-1438 Phone Number. Topic subject area number of pages spacing urgency academic level number of sources style and preferred language style.

If you renew online you will receive your registration in the mail within 7-10 business days. If your business is located within an incorporated municipality city limits a City Business Tax Receipt must be procured before a Brevard County Business Tax Receipt can be issued. Phone number 305 295-5000.

It is very easy. Local Business Tax FAQs. Payments can be made Monday through Friday from 8 am.

If you encounter a feature on our website that you cannot access due to disability please contact us. You may be required to obtain a Federal ID number. To pay by phone call the nCourt payment center at 561 207-7189.

View information about obtaining and renewing a Palm Beach County business tax receipt. Furnished patio area all on the main floor with a banquet room and veranda with seating for 200 located on the third floor. The Columbia County Tax Collectors office is committed to ensuring accessibility to this website regardless of disability.

Here there is a form to fill. Text STORM to 51555 to receive a link. Administration Building 130 High Street 2nd Floor - Hamilton OH 45011 Phone.

Register and E-File Documents Using the Statewide Portal. The report also provides basic information about businesses or landlords ie address phone number. PROPERTY TAX INFORMATION RELATED TO PROPERTY TAX BILLS AND PAYMENTS Mailing Address.

Contact Numbers for Information. To donate via credit card call 561-686-3530. Address or tax receipt number.

Palm Beach County Local Business Tax Receipt 305 300 0364

Permit Source Information Blog

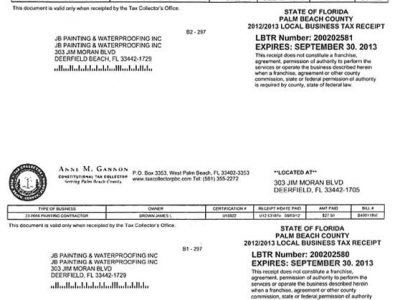

Licences Certificate Of Competency Registration Jb Painting Waterproofing Inc

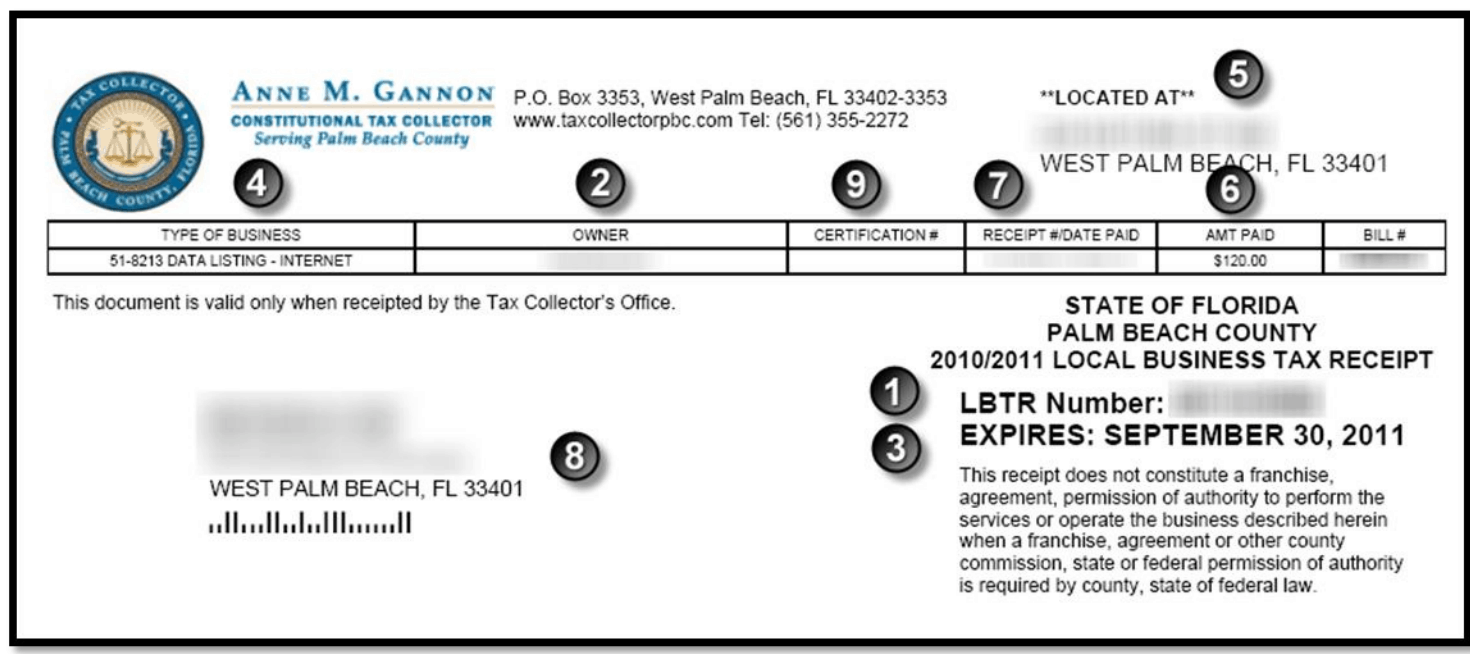

Local And County Tax Receipt Laws In Palm Beach County

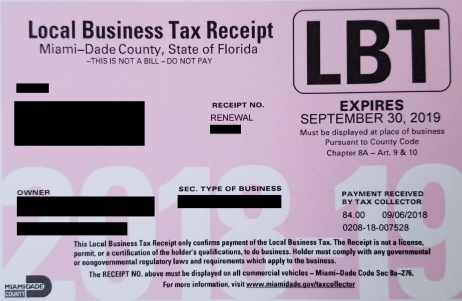

Miami Dade County Local Business Tax Receipt 305 300 0364

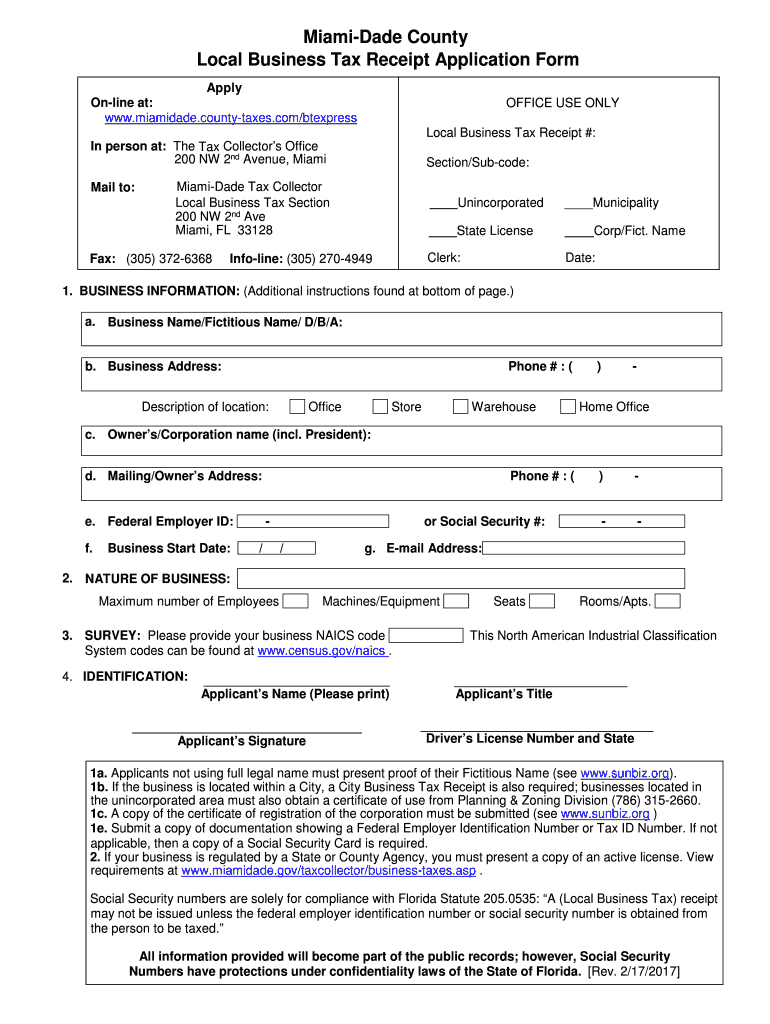

Fl Local Business Tax Receipt Application Form Miami Dade County 2017 2022 Fill Out Tax Template Online Us Legal Forms

Pembroke Park Area Broward County Local Business Tax Receipt 305 300 0364